Natural Hydrogen:

A game changing new energy source

Created by nature and widely available

Produced without CO2 emissions

As cheap as fossil fuels with a cost of ~$1/Kg

2-5 times cheaper than other types of hydrogen

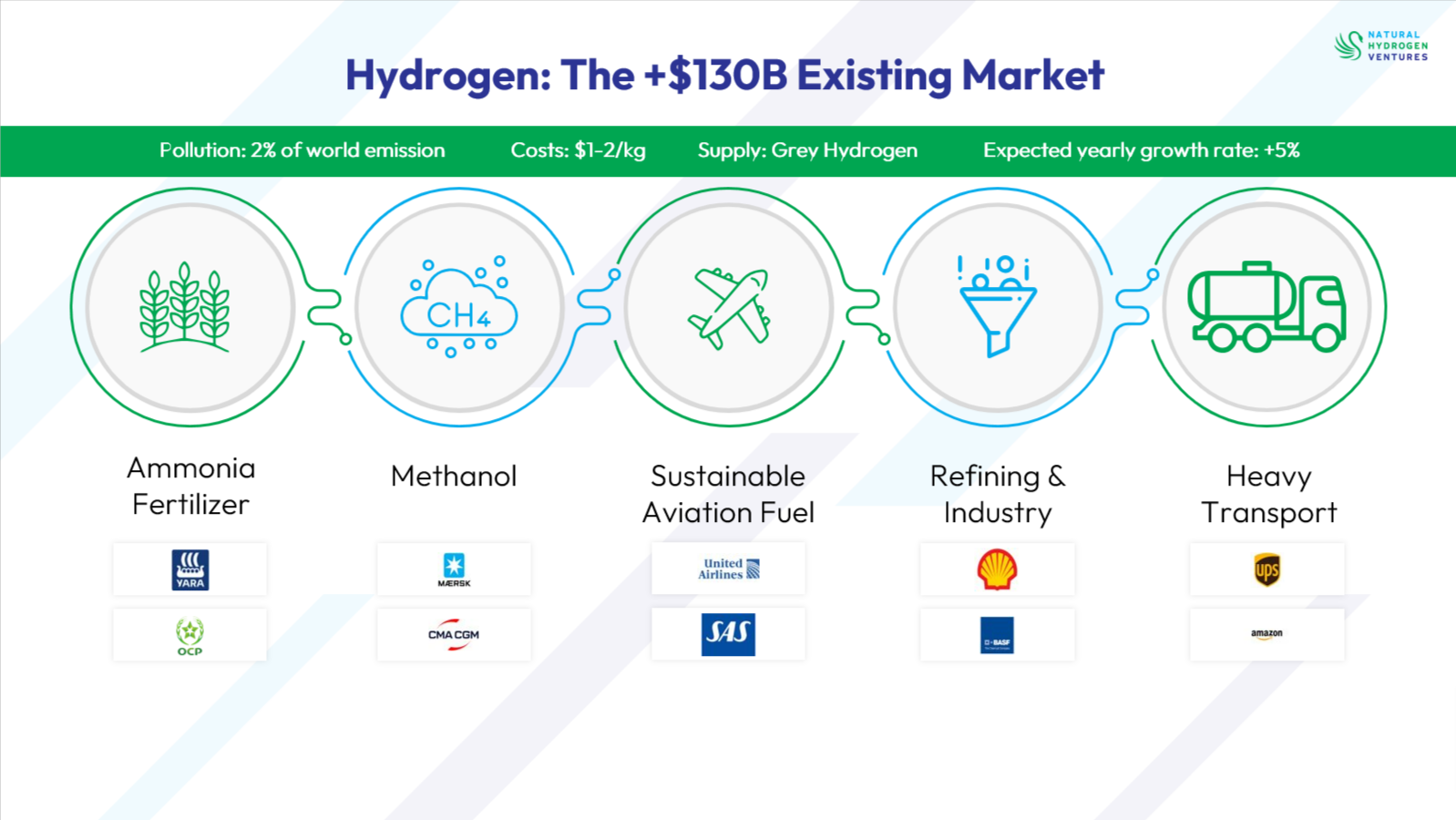

An existing $130B market

Potentially avoiding ~40% of world emissions

Estimated to be able to meet global energy demand for hundreds of years

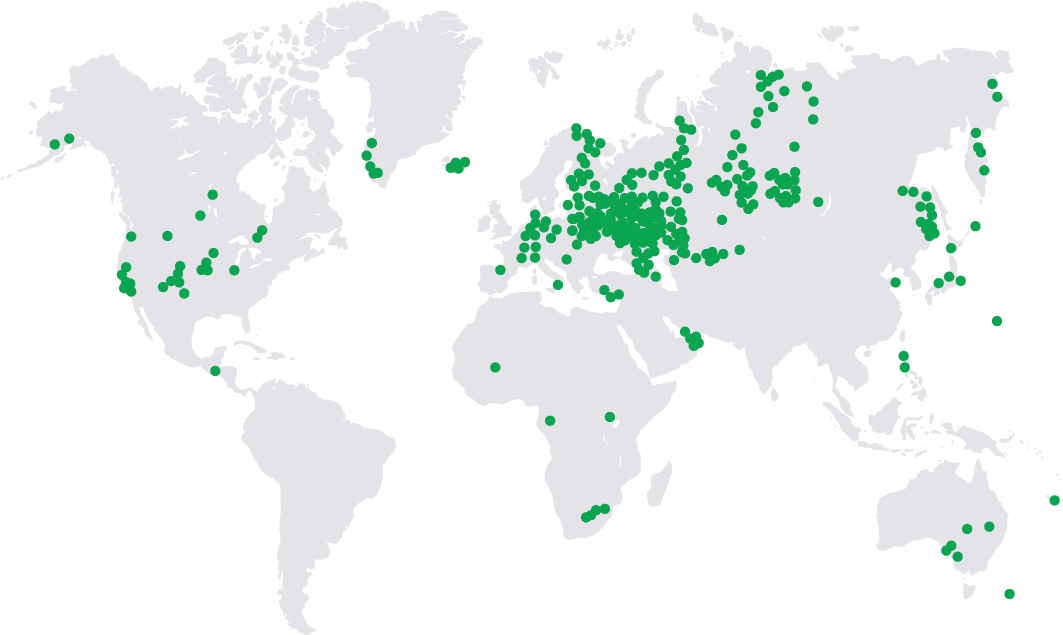

The map showcases locations where Natural Hydrogen has been inadvertently discovered, primarily during drilling operations for oil or water. As exploration efforts for Natural Hydrogen continue to expand, the number of pins on the map will increase exponentially.

About us

Investment thesis:

We believe that the imminent arrival of game-changing, affordable, and widely available zero-emission hydrogen in the form of Natural Hydrogen heralds a transformative shift.

With its potential to facilitate the commercial use of hydrogen in various industries, devoid of subsidies, Natural Hydrogen stands poised to revolutionize not only the existing hydrogen economy but also the broader energy landscape. Consequently, it presents extraordinary investment opportunities.

Why Us?

We are uniquely positioned to seize the burgeoning investment opportunities presented by Natural Hydrogen. Here's why:

Expertise: We have dedicated ourselves to exhaustive research and strategic investments in Natural Hydrogen, establishing ourselves as industry experts. Our in-depth understanding of this emerging sector enables us to navigate its complexities with precision and foresight.

Comprehensive Perspective: With a 360-degree view of the industry, we possess a holistic understanding of its dynamics, from production to utilization. This comprehensive perspective allows us to identify promising opportunities and mitigate risks effectively.

Value Beyond Capital: As a specialized investor, we offer more than just financial backing to our portfolio companies. We provide strategic guidance, operational expertise, and access to our extensive network, empowering them to thrive in a rapidly evolving market environment.

Extensive Network: Our robust network extends to industry leaders, leading scientists, and related sectors, providing us with invaluable insights, partnerships, and collaboration opportunities. This network enables us to stay at the forefront of innovation and leverage cutting-edge technologies.

Market Focus: By concentrating on existing markets for natural hydrogen, we capitalize on immediate opportunities while strategically positioning ourselves for long-term growth. Our focused approach allows us to deploy resources efficiently and maximize returns for our co-investors.

In essence, our deep industry knowledge, comprehensive perspective, value-added approach, extensive network, and strategic market focus make us the ideal partner to capitalize on the transformative potential of Natural Hydrogen.

Morten Stahl - LinkedIn

Founding Partner & Investor

Philip Ball - LinkedIn

Partner & Chief Scientist

Our motivation:

Be a good ancestor

We are motivated by our desire to be good ancestors.

We strive to embody this by pursuing two objectives:

Firstly, by investing in game-changing industries with immense profit potential, we aim to generate wealth for both our own and our investors' children.

Secondly, we endeavor to create this wealth through investments that mitigate catastrophic climate change, thereby fulfilling our responsibility as good ancestors for future generations worldwide.

We believe that investing in Natural Hydrogen represents the optimal approach to achieving both profit and impact, thereby fulfilling our commitment to being good ancestors.

Our sectors: Core Natural Hydrogen

Description: Companies engaged in the exploration of Natural Hydrogen or the development of industry-specific technologies. Examples include:

Exploration for Natural Hydrogen

Enhanced Natural Hydrogen production technologies

Stimulated Natural Hydrogen technologies

Hydrogen extraction from Geothermal wells

Stimulated hydrogen production from decommissioned oil and gas wells (with carbon sequestration)

Our Value Add

We add value to portfolio companies in this sector by leveraging our specialization. With an in-depth, comprehensive understanding of the emerging Natural Hydrogen industry, we provide our portfolio companies with technical and commercial support. Additionally, we facilitate connections with technology providers, other investors, project financiers, infrastructure developers, and potential off-takers.

Our sectors: Related Technologies

Description: Companies that develop or possess products with significant potential in the emerging Natural Hydrogen industry. Examples include:

Small-scale ammonia, methanol, or SAF (Sustainable Aviation Fuel) plants

Hydrogen transport and handling technologies

Compressor technologies

Gas separation technologies such as membranes

Drilling technologies

Exploration technologies

Hydrogen sensors

Our Value Add

We add value to portfolio companies in this sector by introducing them to the Natural Hydrogen market, often a previously unknown market to them. We connect them with scientists, industry players, potential customers, and pilot projects, thereby facilitating opportunities for growth and expansion.

Targeting Existing Hydrogen Markets

Hydrogen has the potential to replace fossil fuels in numerous industries. However, the realization of this transition depends on factors such as the enactment of appropriate legislation, the development of specialized infrastructure, and advancements in related or competing technologies.

Consequently, the demand from certain industries, despite their promise, may never materialize or may only do so after several years.

Considering that our investment fund operates on a 10-year horizon, we focus solely on companies targeting existing markets for hydrogen. These markets include industries already utilizing hydrogen, which collectively account for more than 2% of global emissions and often lack viable alternatives. The expected annual growth rate of these industries exceeds 5%.

Why the Green Swan?

Our logo, the green swan, symbolizes our focus on investing in technologies that are rare, unexpected, and potentially transformative in rapidly reducing climate-destructive emissions. Inspired by Nassim Nicholas Taleb's theory on Black Swan events, it embodies our commitment to seeking out impactful yet overlooked opportunities.